Compare travel insurance providers is essential for ensuring peace of mind during your adventures abroad. With various options available, it’s vital to understand what sets these providers apart so you can make an informed decision. This guide will delve into key features, coverage limits, and customer reviews to help you navigate the often-complex world of travel insurance.

From understanding exclusions that may impact your coverage to evaluating customer experiences, we will provide you with the tools needed to compare travel insurance providers effectively. Whether you’re a frequent flyer or planning a once-in-a-lifetime trip, knowing what to look for can save you both time and money.

Compare Travel Insurance Providers

When planning a trip, one of the most critical steps is selecting the right travel insurance provider. With numerous options available, understanding the nuances that differentiate these providers can save you from unforeseen hassles during your travels. This discussion will highlight key features to consider when comparing travel insurance providers, the significance of coverage limits and exclusions, and how to effectively evaluate customer feedback.

Key Features Differentiating Travel Insurance Providers

As you explore various travel insurance options, several distinguishing features can significantly impact your choice. It’s essential to look for:

- Types of Coverage: Travel insurance can vary widely, including coverage for trip cancellations, medical emergencies, and lost belongings. Some providers may offer specialized coverage for adventure sports or COVID-19 related incidents.

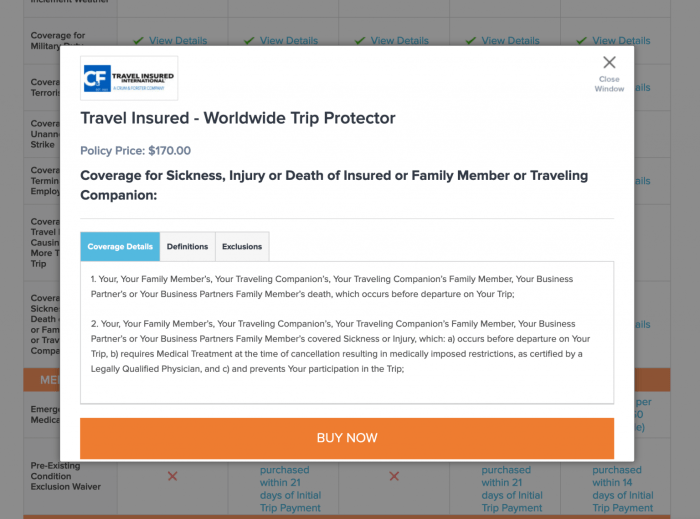

- Cost: Premiums can differ based on the provider and the coverage level. Assessing the cost against the benefits offered is crucial.

- Geographical Coverage: Ensure that your policy covers all your travel destinations. Some insurers may have exclusions for specific countries or regions.

- Customer Service: The availability of support, especially during emergencies, is vital. Look for providers with 24/7 customer service.

- Claims Process: A straightforward and efficient claims process can make a significant difference when you need to file a claim.

Importance of Coverage Limits and Exclusions

Understanding the coverage limits and exclusions is essential to ensure that you are adequately protected during your travels. Every travel insurance policy has limits on how much it will pay for various types of claims, which can impact your financial protection.

Coverage limits dictate the maximum payout for different claims, while exclusions detail what is not covered by the policy.

When reviewing a policy, it’s crucial to pay attention to:

- Medical Expenses: Limits for medical coverage can vary significantly. Ensure the limit is sufficient for potential healthcare costs in your destination.

- Trip Cancellation Coverage: Understand the maximum amount you can claim if you need to cancel your trip for covered reasons.

- Exclusions for Pre-existing Conditions: Many policies have strict guidelines regarding pre-existing medical conditions. Ensure you know how these can affect your coverage.

Evaluating Customer Reviews and Ratings

Customer reviews and ratings can provide valuable insights into the reliability and quality of travel insurance providers. When assessing these reviews, consider the following aspects:

- Overall Satisfaction: Look for general sentiment in customer feedback; high ratings often correlate with better service experiences.

- Claim Settlement Ratio: This ratio indicates how many claims are settled successfully compared to the total claims filed. A higher ratio points to a more reliable provider.

- Customer Experience: Analyze comments regarding the claims process, customer service responsiveness, and overall satisfaction with the policy coverage.

- Policy Clarity: Customers often comment on the clarity of the policy terms; straightforward policies are generally preferred.

Understanding these factors can empower you to make an informed choice when comparing travel insurance providers, ensuring your travels are protected and your peace of mind is maintained.

Related Insurance Types

Travel insurance is specifically designed to protect travelers against unforeseen circumstances that may occur during their journeys, such as trip cancellations, medical emergencies, and lost luggage. On the other hand, pet insurance covers veterinary expenses for pets, including accidents and illnesses. While both types of insurance provide essential coverage, they serve distinct purposes and target different aspects of life. Understanding these differences can help travelers make informed decisions about their coverage needs.

Differences between Travel Insurance and Pet Insurance

Travel insurance focuses on safeguarding your travel investments and ensuring your safety while away from home. It often includes coverage for trip cancellations, interruptions, medical emergencies abroad, and lost or delayed baggage. In contrast, pet insurance is primarily concerned with the health and well-being of your furry companions, covering veterinary bills, medications, and some preventive care. Key distinctions include:

- Scope of Coverage: Travel insurance covers events that occur during a trip, whereas pet insurance addresses health-related incidents involving pets.

- Claim Process: Travel insurance claims often require documentation of travel-related issues, while pet insurance claims need veterinary records and invoices.

- Policy Duration: Travel insurance is usually purchased for the duration of a trip, while pet insurance is often an ongoing policy that covers a pet’s health for life.

Supplemental Insurance Options

Supplemental insurance options can enhance your travel insurance plan, providing additional layers of protection. These options cater to specific needs that standard travel insurance policies may not fully cover. Consider the following supplemental insurance options:

- Medical Evacuation Insurance: This coverage is critical for travelers visiting remote areas where immediate medical care may not be available. It ensures you can be transported to a suitable medical facility if necessary.

- Rental Car Insurance: If you plan to rent a car during your travels, this insurance can protect you against damages or theft that your primary travel insurance might not cover.

- Cancel for Any Reason Insurance: This option allows you to cancel your trip for any reason and receive a refund, providing greater flexibility than standard cancellation policies.

Significance of Umbrella Insurance

Umbrella insurance is a supplemental policy that provides additional liability coverage beyond what is included in standard insurance policies, including travel insurance. It is particularly significant for travelers, as it can protect against unexpected liabilities that may arise during a trip.The importance of umbrella insurance can be summarized as follows:

- Extended Coverage: It offers a higher limit on liability claims, which can be crucial in case of severe accidents or incidents resulting in substantial damages or legal fees.

- Global Protection: Umbrella insurance typically provides coverage that extends beyond your home country, safeguarding you against claims that could arise while traveling.

- Peace of Mind: Having umbrella insurance allows you to enjoy your travel experience without worrying excessively about potential liabilities.

Insurance Coverage in Specific Contexts

The world of travel insurance is vast and varied, extending beyond the typical trip protection to cover specialized needs. Different types of insurance can provide essential coverage tailored to unique activities and circumstances that travelers may encounter. This section delves into specific contexts where specialized insurance coverage is particularly relevant, including vision insurance for travelers, watercraft insurance for boating activities, and how to integrate various insurance types for comprehensive protection.

Vision Insurance Options for Travelers

Vision insurance is often overlooked when planning a trip, but it can be vital for those who rely on corrective lenses or have ongoing eye care needs. Travelers may face unexpected situations, such as losing glasses or requiring urgent eye care while abroad. Here’s why vision insurance can be essential:

- Coverage for Eye Emergencies: Many vision insurance policies include coverage for emergency eye care, which is crucial if you encounter an unforeseen issue during your travels.

- Prescription Eyewear Benefits: Having a policy that covers the cost of prescription glasses or contact lenses can save you from hefty out-of-pocket expenses if your eyewear gets lost or damaged.

- Access to Vision Care Providers: Some vision insurance plans have a network of providers, ensuring you can find local care quickly, regardless of your travel destination.

Watercraft Insurance for Boating Activities

Traveling often means engaging in various activities, including boating. Watercraft insurance is designed to protect boat owners and operators against risks associated with these activities. Understanding its significance can enhance safety and financial security when exploring waterways:

- Liability Coverage: This protects you against claims for bodily injury or property damage that may occur while operating your boat. It can be particularly important in crowded areas where accidents are more likely to happen.

- Property Damage Protection: Coverage for damages to your watercraft or any equipment on board ensures you won’t face overwhelming repair costs following an incident.

- Coverage for Passengers: Many policies include provisions for medical expenses incurred by passengers, ensuring they receive care without financial burden in the event of an accident.

Integration of Different Insurance Types for Comprehensive Protection

Combining various types of insurance can create a comprehensive safety net for all aspects of your travel. Integrating policies not only enhances coverage but can also result in cost savings. Here’s how different insurance types can work together effectively:

- Combining Health and Travel Insurance: This ensures you have access to medical care while traveling, covering both routine and emergency needs.

- Incorporating Vision Insurance: Adding vision coverage to your health plan ensures all aspects of your eye care are addressed, particularly important for long trips.

- Watercraft Insurance with Liability Coverage: If you’re engaged in boating while traveling, having both watercraft insurance and personal liability insurance can protect against a range of potential issues.

Integrating various insurance types can lead to better protection and often lower premium costs, ensuring you travel with peace of mind.

Last Word

In conclusion, comparing travel insurance providers can significantly enhance your travel experience by ensuring you have the right coverage tailored to your needs. By considering key features, coverage limits, and customer feedback, you can make a well-informed decision. Remember, the right travel insurance not only protects your investment but also offers you peace of mind as you explore the world.

Detailed FAQs

What is the importance of coverage limits in travel insurance?

Coverage limits determine the maximum amount an insurance provider will pay for claims, making it crucial to choose a policy that adequately covers potential expenses.

How can I evaluate customer reviews for insurance providers?

Look for unbiased reviews on trusted platforms, focusing on overall customer satisfaction, claims handling, and responsiveness to inquiries.

Is travel insurance necessary for all trips?

While not mandatory, travel insurance is highly recommended as it protects against unforeseen events like cancellations, medical emergencies, and lost luggage.

Can I purchase travel insurance after booking my trip?

Yes, many insurers allow you to buy travel insurance right up until the day before your trip, but it’s best to purchase it as soon as you book to cover any pre-departure issues.

What should I do if I have a pre-existing condition?

Look for policies that offer coverage for pre-existing conditions or consider a waiver option that extends coverage to such issues.